Assessors

Email:

revere_assessors@revere.org

Mail:

City of Revere

Assessors Department

281 Broadway

Revere, MA 02151.

The Revere Assessors Department provides exceptional, methodical services to the residents and businesses of Revere. Our mission is to administer the City's assessment program in a manner that assures public confidence in our accuracy, productivity, and fairness in accordance with Massachusetts General laws and regulations of the Massachusetts Department of Revenue. In agreement with such laws, we administer motor vehicle excise, abatements, and statutory exemption programs. We address questions and concerns of property owners and residents with integrity and professionalism striving to deliver excellence in public service.

revere_assessors@revere.org

Mail:

City of Revere

Assessors Department

281 Broadway

Revere, MA 02151.

The Revere Assessors Department provides exceptional, methodical services to the residents and businesses of Revere. Our mission is to administer the City's assessment program in a manner that assures public confidence in our accuracy, productivity, and fairness in accordance with Massachusetts General laws and regulations of the Massachusetts Department of Revenue. In agreement with such laws, we administer motor vehicle excise, abatements, and statutory exemption programs. We address questions and concerns of property owners and residents with integrity and professionalism striving to deliver excellence in public service.

Assessors Database

The City of Revere provides two online tools anyone can use to look up property information:

- Patriot Properties provides detailed assessing information on each property in Revere.

- The City’s GIS system provides access to helpful maps and mapping tools.

Reduce or Defer Your Taxes

Below is a breakdown of the different exemptions the city offers. All exemptions have ownership and occupancy requirements. If a property is in trust the applicant must be the trustee and beneficiary of the trust or hold a life estate to meet ownership requirement.

Senior Exemption

Clause 41C ½ - $TBD (10% of average assessed value of all residential properties)

- Age 65 as of July 1st of the fiscal year

- Own and occupy property

- Applicant income < $72,000

Clause 17D - $375.00

- Age 70 or a widow/widower as of July 1st of the fiscal year

- Assets < $82,839

Veteran Exemptions

Blind Exemption

Hardship Exemptions

Optional additional exemption

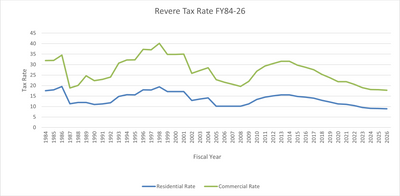

Historical Tax Rates

View Complete Table for FY84 to FY26

Forms

Helpful Links

FAQ

Are your maps online?

What is the amount of my motor vehicle excise?

Do all assessments change at the same rate?